How Much Taxes Do You Pay When You Sell A House In California . Taxes involve capital gains tax as well as possibly withholding and transfer. You do not have to report the sale of your home if all of the following apply: if your expenses, like real estate commissions, were $20,000, your capital gain would be reduced to $180,000. Compare your rate to the california and u.s. — learn how to calculate capital gains on the sale of property in california. Find out how much you owe and how to determine your tax. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. — not everyone will owe taxes for the sale of their home — there are plenty of exceptions and personal circumstances that will impact your tax. California sellers may have to pay federal capital gains tax. Your gain from the sale was less. — » what taxes do you pay when selling a california house? — how much do you pay in taxes when you sell a home in california?

from taxwalls.blogspot.com

— how much do you pay in taxes when you sell a home in california? Compare your rate to the california and u.s. Find out how much you owe and how to determine your tax. — not everyone will owe taxes for the sale of their home — there are plenty of exceptions and personal circumstances that will impact your tax. — learn how to calculate capital gains on the sale of property in california. Your gain from the sale was less. Taxes involve capital gains tax as well as possibly withholding and transfer. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. — » what taxes do you pay when selling a california house? You do not have to report the sale of your home if all of the following apply:

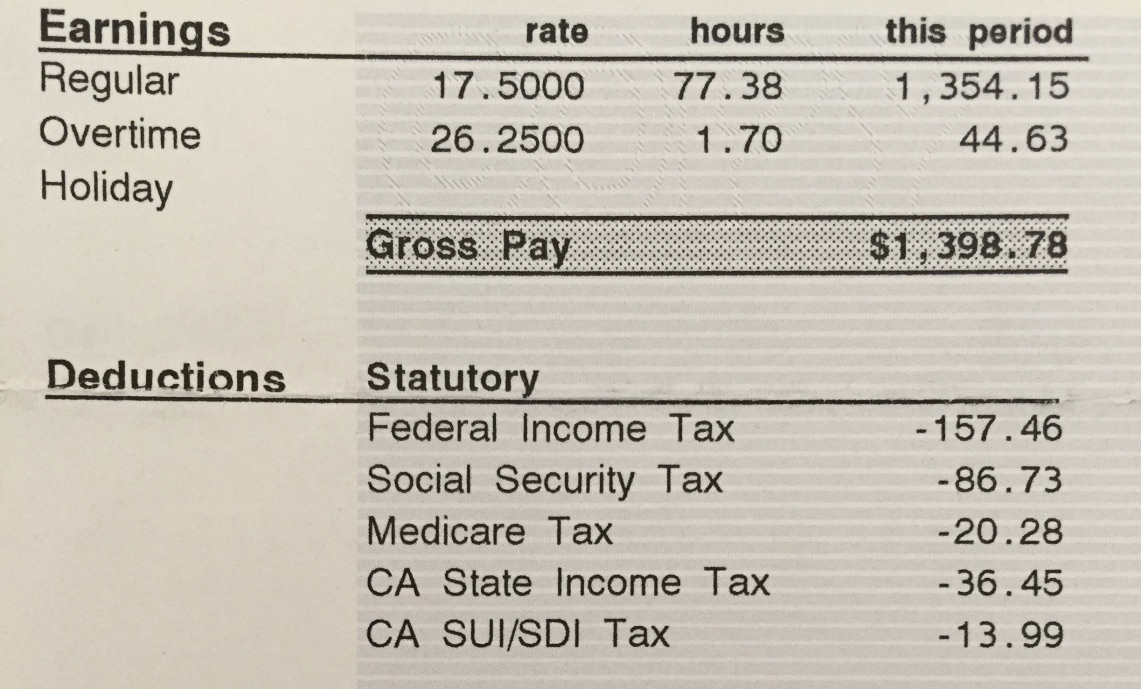

How To Calculate Paycheck After Taxes In California Tax Walls

How Much Taxes Do You Pay When You Sell A House In California calculate how much you'll pay in property taxes on your home, given your location and assessed home value. California sellers may have to pay federal capital gains tax. Taxes involve capital gains tax as well as possibly withholding and transfer. You do not have to report the sale of your home if all of the following apply: if your expenses, like real estate commissions, were $20,000, your capital gain would be reduced to $180,000. — » what taxes do you pay when selling a california house? Your gain from the sale was less. — not everyone will owe taxes for the sale of their home — there are plenty of exceptions and personal circumstances that will impact your tax. — how much do you pay in taxes when you sell a home in california? — learn how to calculate capital gains on the sale of property in california. Compare your rate to the california and u.s. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Find out how much you owe and how to determine your tax.

From www.stessa.com

How Much Tax Do You Pay When You Sell a Rental Property? How Much Taxes Do You Pay When You Sell A House In California if your expenses, like real estate commissions, were $20,000, your capital gain would be reduced to $180,000. — learn how to calculate capital gains on the sale of property in california. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Find out how much you owe and how. How Much Taxes Do You Pay When You Sell A House In California.

From www.stessa.com

How Much Tax Do You Pay When You Sell a Rental Property? How Much Taxes Do You Pay When You Sell A House In California Compare your rate to the california and u.s. California sellers may have to pay federal capital gains tax. — » what taxes do you pay when selling a california house? — how much do you pay in taxes when you sell a home in california? Find out how much you owe and how to determine your tax. . How Much Taxes Do You Pay When You Sell A House In California.

From www.youtube.com

What Taxes do you pay when Buying or Selling a house? YouTube How Much Taxes Do You Pay When You Sell A House In California if your expenses, like real estate commissions, were $20,000, your capital gain would be reduced to $180,000. — learn how to calculate capital gains on the sale of property in california. Your gain from the sale was less. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Compare. How Much Taxes Do You Pay When You Sell A House In California.

From www.youtube.com

How much tax do you pay when you sell a house? YouTube How Much Taxes Do You Pay When You Sell A House In California California sellers may have to pay federal capital gains tax. — how much do you pay in taxes when you sell a home in california? You do not have to report the sale of your home if all of the following apply: — not everyone will owe taxes for the sale of their home — there are plenty. How Much Taxes Do You Pay When You Sell A House In California.

From taxwalls.blogspot.com

How Much Are California State Taxes Tax Walls How Much Taxes Do You Pay When You Sell A House In California Find out how much you owe and how to determine your tax. if your expenses, like real estate commissions, were $20,000, your capital gain would be reduced to $180,000. You do not have to report the sale of your home if all of the following apply: calculate how much you'll pay in property taxes on your home, given. How Much Taxes Do You Pay When You Sell A House In California.

From exogpanps.blob.core.windows.net

Do You Pay Sales Tax On A New Home at Lucia Nguyen blog How Much Taxes Do You Pay When You Sell A House In California Taxes involve capital gains tax as well as possibly withholding and transfer. if your expenses, like real estate commissions, were $20,000, your capital gain would be reduced to $180,000. California sellers may have to pay federal capital gains tax. Compare your rate to the california and u.s. — not everyone will owe taxes for the sale of their. How Much Taxes Do You Pay When You Sell A House In California.

From www.northwooduk.com

Rental Tax Guide How Much Tax Do You Pay How Much Taxes Do You Pay When You Sell A House In California if your expenses, like real estate commissions, were $20,000, your capital gain would be reduced to $180,000. Find out how much you owe and how to determine your tax. Your gain from the sale was less. California sellers may have to pay federal capital gains tax. Compare your rate to the california and u.s. — how much do. How Much Taxes Do You Pay When You Sell A House In California.

From www.hippo.com

Your Guide to Property Taxes Hippo How Much Taxes Do You Pay When You Sell A House In California — » what taxes do you pay when selling a california house? Find out how much you owe and how to determine your tax. Compare your rate to the california and u.s. Taxes involve capital gains tax as well as possibly withholding and transfer. if your expenses, like real estate commissions, were $20,000, your capital gain would be. How Much Taxes Do You Pay When You Sell A House In California.

From www.youtube.com

How much tax do you pay when you sell a house in Alberta? YouTube How Much Taxes Do You Pay When You Sell A House In California California sellers may have to pay federal capital gains tax. Taxes involve capital gains tax as well as possibly withholding and transfer. You do not have to report the sale of your home if all of the following apply: if your expenses, like real estate commissions, were $20,000, your capital gain would be reduced to $180,000. — ». How Much Taxes Do You Pay When You Sell A House In California.

From www.bettercapital.us

How Much Tax Do You Pay When You Sell A Rental Property? Better Capital Rental Property Real How Much Taxes Do You Pay When You Sell A House In California — learn how to calculate capital gains on the sale of property in california. — how much do you pay in taxes when you sell a home in california? Find out how much you owe and how to determine your tax. — not everyone will owe taxes for the sale of their home — there are plenty. How Much Taxes Do You Pay When You Sell A House In California.

From taxwalls.blogspot.com

How Much Tax Do You Pay On House Sale Tax Walls How Much Taxes Do You Pay When You Sell A House In California if your expenses, like real estate commissions, were $20,000, your capital gain would be reduced to $180,000. — how much do you pay in taxes when you sell a home in california? — » what taxes do you pay when selling a california house? Compare your rate to the california and u.s. Taxes involve capital gains tax. How Much Taxes Do You Pay When You Sell A House In California.

From creativeadvisors.org

How Much Tax Do You Pay When You Sell A House? How Much Taxes Do You Pay When You Sell A House In California — not everyone will owe taxes for the sale of their home — there are plenty of exceptions and personal circumstances that will impact your tax. Find out how much you owe and how to determine your tax. — how much do you pay in taxes when you sell a home in california? Your gain from the sale. How Much Taxes Do You Pay When You Sell A House In California.

From fnrpusa.com

How to Estimate Commercial Real Estate Property Taxes FNRP How Much Taxes Do You Pay When You Sell A House In California Your gain from the sale was less. California sellers may have to pay federal capital gains tax. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Compare your rate to the california and u.s. if your expenses, like real estate commissions, were $20,000, your capital gain would be reduced. How Much Taxes Do You Pay When You Sell A House In California.

From www.youtube.com

How much taxes do you pay on a 1099K? YouTube How Much Taxes Do You Pay When You Sell A House In California You do not have to report the sale of your home if all of the following apply: Find out how much you owe and how to determine your tax. — not everyone will owe taxes for the sale of their home — there are plenty of exceptions and personal circumstances that will impact your tax. — learn how. How Much Taxes Do You Pay When You Sell A House In California.

From taxwalls.blogspot.com

How To Calculate Paycheck After Taxes In California Tax Walls How Much Taxes Do You Pay When You Sell A House In California You do not have to report the sale of your home if all of the following apply: — » what taxes do you pay when selling a california house? Compare your rate to the california and u.s. — not everyone will owe taxes for the sale of their home — there are plenty of exceptions and personal circumstances. How Much Taxes Do You Pay When You Sell A House In California.

From sundae.com

What Taxes Do You Pay When Selling a House? Sundae How Much Taxes Do You Pay When You Sell A House In California if your expenses, like real estate commissions, were $20,000, your capital gain would be reduced to $180,000. California sellers may have to pay federal capital gains tax. You do not have to report the sale of your home if all of the following apply: Taxes involve capital gains tax as well as possibly withholding and transfer. calculate how. How Much Taxes Do You Pay When You Sell A House In California.

From exowjsnub.blob.core.windows.net

Do You Pay Taxes On Sale Of House In Trust at Emily Banks blog How Much Taxes Do You Pay When You Sell A House In California if your expenses, like real estate commissions, were $20,000, your capital gain would be reduced to $180,000. California sellers may have to pay federal capital gains tax. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. — » what taxes do you pay when selling a california house?. How Much Taxes Do You Pay When You Sell A House In California.

From www.self.inc

Life of Tax How Much Tax is Paid Over a Lifetime Self. How Much Taxes Do You Pay When You Sell A House In California California sellers may have to pay federal capital gains tax. — how much do you pay in taxes when you sell a home in california? calculate how much you'll pay in property taxes on your home, given your location and assessed home value. if your expenses, like real estate commissions, were $20,000, your capital gain would be. How Much Taxes Do You Pay When You Sell A House In California.